-

Consumers Save $10,662 Working With a Mortgage Broker

A recent study by Polygon Research, supported by Willow Canyon Advisors and United Wholesale Mortgage (UWM), reveals that consumers save an average of $10,662 over the life of a loan when working with independent mortgage brokers compared to nonbank retail lenders. The research, based on 2023 Home Mortgage Disclosure Act (HMDA) data, highlights that the…

-

Major Changes in Real Estate Industry: National Association of Realtors Settles Commission Lawsuits

The real estate landscape in the United States is on the brink of significant transformation as the National Association of Realtors (NAR) recently agreed to pay a whopping $418 million in damages to settle commission lawsuits. This landmark settlement will not only reshape how millions of sellers and buyers transact but also how agents and…

-

New FHA Program Offers Temporary Mortgage Relief Amid Rising Interest Rates

The Federal Housing Administration (FHA) has introduced a new initiative known as the Payment Supplement program aimed at assisting struggling borrowers by offering temporary relief in the form of reduced monthly mortgage payments, all without altering their existing interest rates. Under this program, mortgage servicers can utilize funds from a “partial claim,” an interest-free second…

-

Investors scooping up low priced homes

Investors are increasingly scooping up low-priced homes, according to a new report from Redfin. The report found that investors bought a record 26% of homes in the lowest price tier during the fourth quarter of 2022. This is up from 19% in the previous quarter and 16% a year earlier. Investors are attracted to low-priced…

-

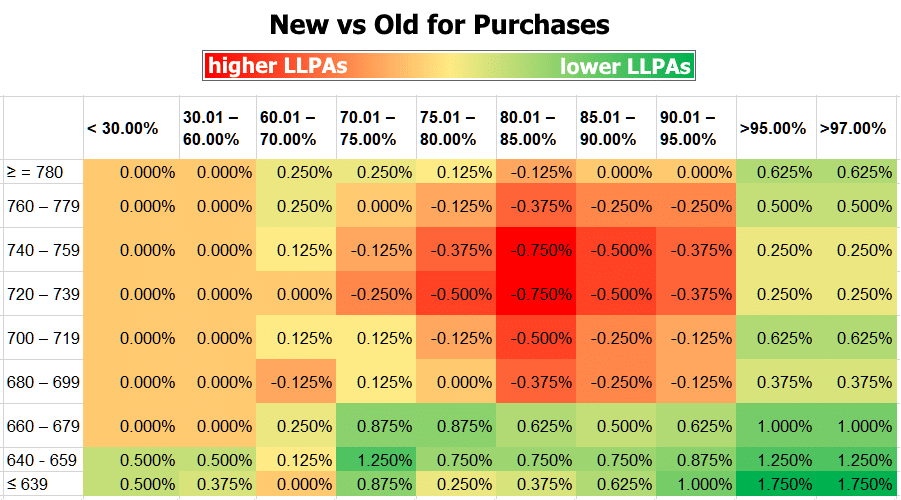

Fact-checking the confusion around changes to mortgage fees based on credit scores

A change to Loan Level Price Adjustments (LLPAs) by Fannie Mae and Freddie Mac in January 2023 has caused confusion among borrowers. While some have claimed that those with lower credit scores will now pay less than those with higher credit scores, this is not the case. LLPAs are based on loan features such as…

-

The U.S. housing market will continue to be impacted by 3% mortgage rates as homeowners are unwilling to sell and lose their low rates.

The US housing market is being impacted by higher mortgage rates and a lock-in effect, which is constraining both buyers and sellers. The average 30-year fixed mortgage rate reached 7.10% in February 2022, the highest since November 2021, resulting in a drop in demand for properties. Meanwhile, homeowners who locked in lower mortgage rates are…

-

FHA Loans Are Getting Cheaper

It has been announced that the annual mortgage insurance premium will be reduced by 0.30 percentage points, from 0.85% to 0.55% for most new borrowers, which will save homebuyers and homeowners with new FHA-insured mortgages an average of $800 per year. The reduction in the premium is expected to lower housing costs for an estimated…

-

Tips to Help Improve Your Credit Score

Here are some basic tips that can help improve your credit score: Remember, improving your credit score takes time and effort. Stick to these tips and be patient, and you should see improvement over time.

-

Inflation remains too high

The Federal Reserve aims to maintain an annual inflation rate of approximately 2% at the core level, which is an economic measure that excludes volatile components such as food and energy prices. The Consumer Price Index for this month indicates a core level of 0.4%, which is not expected to persist. However, if such inflation…

-

Pros and Cons of a Temporary Interest Rate Buydown

A temporary interest rate buydown is a type of financing option where a homebuyer pays an up-front fee to lower the interest rate on their mortgage loan for a limited period of time, typically the first few years of the loan. Here are some of the pros and cons of a temporary interest rate buydown:…